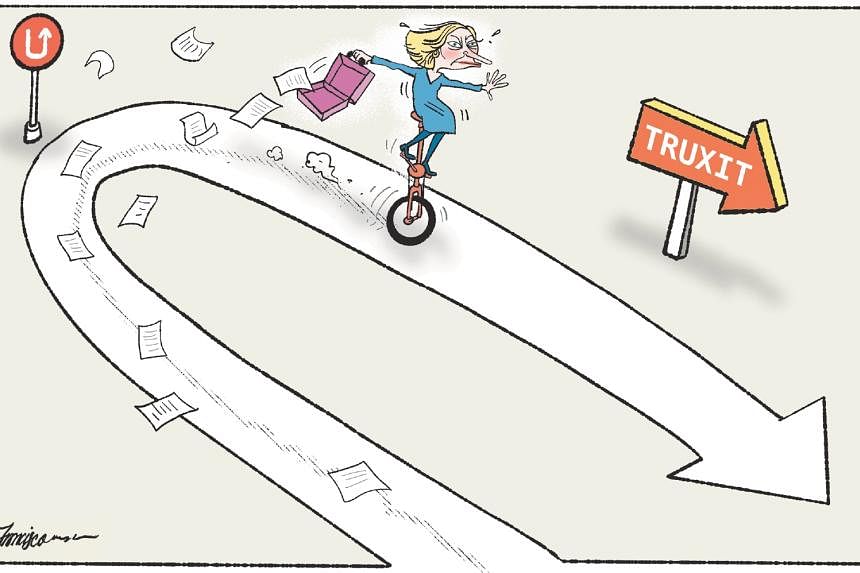

British Prime Minister Liz Truss enjoyed only seven days of full power before global economic forces effectively

destroyed her government.

PHOTO: REUTERS

Whatever you may think of them, the British used to enjoy the reputation of a solid, well-run and responsible nation.

A centuries-old history of peaceful political change, with none of the coups, revolutions or civil wars that seem to have afflicted most other countries worldwide. A robust parliamentary system of government in which just two political parties take their turns in holding power based on electoral procedures that produce clear-cut results and solid governments with none of the unpredictable and often unstable coalition-making that afflicts most of the rest of Europe.

To be sure, the country’s politicians have always been of variable quality. But the United Kingdom’s civil service was highly rated for its professionalism and integrity, and so was its legal system, still considered an advantage and often touted as a national asset by many countries around the world.

That’s why Britain’s sudden descent into crisis looks so surprising. In just a few weeks, the credibility of some of the most critical institutions in British national life, including the prime minister, the Treasury, the Bank of England, the ruling Conservative Party, and the nation’s asset management industry, were all torn to shreds.

The country’s currency has sunk to its lowest levels in half a century, and the risk premium international investors demand to lend money to Britain is among the highest in the industrialised world.

For the first time in modern history, the British government was forced to bow to the pressure of global financial markets and withdraw a budget it had introduced only two weeks beforehand. And in another highly unusual move, the International Monetary Fund issued a rebuke to Britain using language otherwise reserved for those who manage the economies of poor and vulnerable developing nations.

Truss versus lettuce

Consequently, British Prime Minister Liz Truss, who assumed office only last month, had to ditch her policies before these were even tried, and the speculation in London is that her days are numbered.

The influential Economist newspaper had pointed out that, if one ignores the extended period of official mourning for Queen Elizabeth II – a period during which all politics were suspended – Ms Truss enjoyed only seven days of full power before the forces of the global economy effectively destroyed her government. That, The Economist suggested, is more or less the supermarket “shelf-life of the lettuce”.

Liz Truss may never recover from this cruel jibe: a British tabloid newspaper is currently offering its readers a live video stream of a lettuce head and a photograph of the Prime Minister, accompanied by the question, “which wet lettuce will last longer?”

Britain as a whole is now the butt of international jokes. Politicians in Italy – a country that will soon get its 70th government in almost as many years – have suggested that one of their retired prime ministers may be sent to London to try his hand at managing the British because he can’t do any worse than Britain’s politicians.

Mr Kyriakos Mitsotakis, the Prime Minister of Greece, a country that a decade ago had to be bailed out from national bankruptcy by global financial institutions, told Ms Truss’ government tongue-in-cheek that if they “need experience in dealing with the International Monetary Fund, we’re here to help”.

While the attention is on the UK experience, other economies and major currencies are also currently experiencing global pressure. The British pound may be down around 18 per cent to 20 per cent, but the euro is about 15 per cent weaker, and the Chinese renminbi dropped by an average of 11 per cent against the US dollar. The Bank of Japan recently spent an estimated US$21 billion (S$30 billion) trying to prop up the yen, to no avail.

However, credibility is everything in politics, finance and economics, and the UK government finally managed to lose all of these. Britain’s previously admired institutional framework and its hard-won reputation of certainty in financial policy went down the pan over the past two weeks.

And financial volatility is accompanied by political volatility. Between 1990 and 2010 – two decades – Britain was ruled by only three prime ministers. But from 2010 to now - just over one decade - the country has already known four additional prime ministers and may yet be ready for a fifth. Furthermore, no less than four politicians have served as finance ministers since January this year. These are chaotic politics Italian-style, minus the sun-drenched beaches or the delicious pasta.

More On This Topic

‘Cakeism’ and Brexit

How did Britain get to this sorry state? A mixture of immediate failures by the Truss administration, magnified by a much more entrenched malaise.

Ms Truss won power by resorting to the oldest trick in politics: a promise that voters can have their cake and eat it. She vowed to cut taxes and increase spending, all based on borrowing from financial markets. And she dismissed the arguments of armies of economists who pointed out that hers was not an economic policy but a fantasy.

The more she faced criticism, the more she doubled down on her promises; her pledge to cut taxes became a test of wills, which she was determined to win. So, her ill-fated budget slashed taxes much further than anyone expected and sidelined Britain’s financial regulator and the country’s civil servants.

Ms Truss quickly discovered that one should not attempt to offer a spending bonanza against the backdrop of sharply rising inflation and interest rates, a punishing global energy crisis, as well as a British current account deficit which ballooned to an unprecedented 8 per cent of gross domestic product, and all without providing any indication of how Britain intends to deal with its public finances. The Prime Minister not only ran into a flat rejection by the financial markets, she unleashed a financial rout that could only be addressed by withdrawing her entire budget.

The problem of Ms Truss was not necessarily just the financial figures she peddled but the fact that her ill-conceived budget became totemic for a more comprehensive loss of British political and economic credibility, which has been cumulative over several years.

The chief culprit is Brexit, as the British withdrawal from the European Union is popularly known. The damage that Brexit inflicted on the British economy - in terms of lower growth rates, lower exports and slashed inward investment – is by now well-documented.

But a much more severe impact on British credibility has been the conduct of the country’s political elite during this divorce process from the rest of Europe. The campaign to withdraw from the EU was conducted with lies; those who supported Brexit produced made-up figures about how Britain’s trade with the rest of the world would, supposedly, more than compensate for the loss of duty-free access to European markets.

And anyone who dared contradict the Brexiters by providing actual economic facts and figures was dismissed as part of so-called “project fear”, an alleged plot by the “establishment” to keep Britain shackled to Europe.

The tactic worked not only in pulling Britain out of the EU; it also spawned an entirely new class of British politicians who believe that all they need to do is to ram their policies through regardless of what the economic realities may be and if the facts don’t accord with their views, present “alternative facts”.

During the campaign that propelled her to power, Ms Truss refused to engage in any serious discussion with the critics of her economic policy, just as Mr Boris Johnson, her predecessor as prime minister, declined to explain how Britain would thrive outside the EU. Both politicians operated on the assumption that make-believe economics can become real economics.

And the reason people like them can come to power is to be found in another negative development of British politics.

More On This Topic

Who chooses the party leader?

For many decades, the Conservatives and Labour – the country’s two major historic parties – were mass movements, counting millions of members. But the election of the party leaders who could then become prime ministers was left in the hands of the few, usually just the MPs in either party.

Over the past 15 years, however, mass party membership disappeared: Britain’s Royal Society for the Protection of Birds, for instance, has far more paid-up members than all the political parties combined.

Yet, curiously, the choice of who gets elected as party leader was taken from MPs and given to the parties’ entire membership. The result is that an unrepresentative group of party members – in the case of the ruling Conservatives, only around 160,000 people out of a total population of 68 million – decides who would rule Britain.

If it were left to the MPs alone, Ms Truss would have got nowhere near the Downing Street residence of British prime ministers. But she won on a platform of economic fantasies sold to people who wanted to believe in the enduring myth of having something for nothing.

Ultimately, it was left to the global financial markets to confront Britain with the rude awakening it deserves by presenting the country and its daydreaming politicians with the invoice for their mismanagement.

It’s improbable that Ms Truss will ever recover from its current debacle; the only question is whether the humiliation the UK has just experienced at the hands of global financial markets will bring to an end the age of untruthful politics that has so devalued the country’s administration.

But it won’t be easy to get out of this rut. King Charles III best summed up the national mood when he recently welcomed Prime Minister Truss to an audience with “dear, oh dear!

https://omny.fm/shows/in-your-opinion/is-the-nominated-member-of-parliament-scheme-losin

Source link

Related posts:

Students at Zhejiang Guangsha Vocational

and Technical University of Construction celebrate the upcoming 20th

National Congress of the C...

Strong leadership core to provide ‘certainty,

cohesion and strength’ in new journey A huge artificial flower

basket decorates Tian'anm...

By Martin Jacques

By Martin Jacques

In good hands: Liew having a discussion with former London mayor Boris Johnson. Liew says he has confidence UK government will move the country forward on every front.

In good hands: Liew having a discussion with former London mayor Boris Johnson. Liew says he has confidence UK government will move the country forward on every front.