Is Bretton Woods fit for the 21st century?

Probably the best way to increase global funding is to raise the capital of the global multilateral development banks like the World Bank, Asia Development Bank, etc.

The Bretton Woods negotiations were led by the US chief delegate Harry Dexter White and the eminent British economist John Maynard Keynes. Keynes argued unsuccessfully for the creation of an new international currency called the bancor, whereas the United States preferred to use its own currency.

In 1944, the US had the largest share of world GDP and was a major creditor to economies suffering from the destruction of war. It is no surprise that the Bretton Woods order was largely US-led and designed.

Unfortunately, having the US dollar act as the global reserve currency is both a blessing and curse. The US is able to fund its fiscal and trade deficits easily because the rest of the world prefers to hold the US dollar.

Alternatively, the Austrian Institute for Economic Research thinks that a global financial transactions tax of 0.1 per cent could yield between US$238 billion and US$419 billion per year. Needless to say, the rich who control the electoral process in countries across the world will not allow such tax increases.

Perhaps the best way to increase global funding is to raise the capital of the global multilateral development banks such as the World Bank and Asian Development Bank. If the countries which control the special drawing rights of the IMF can apply their US$650 billion in 2021 to increase the bank’s capital by eight times the leverage, these multilateral development banks can increase their lending by about US$5 trillion.

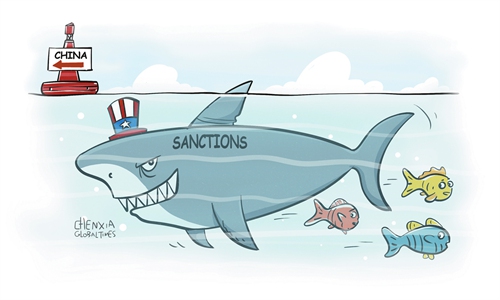

However, doing so would require these countries to agree that this is a priority, which could be unlikely given the current global atmosphere leaning towards protectionism and isolationism.

In short, the 21st century requires multilateral cooperation in dealing with mutual existential challenges involving climate warming, social imbalances and serious polarisation. If the Bretton Woods framework does not serve the Global South because the established powers are unwilling to reform it, do not be surprised if a new set of institutions rise to replace it.

Source link

Open questions | French economist Marc Uzan on how China can help reshape the global financial system

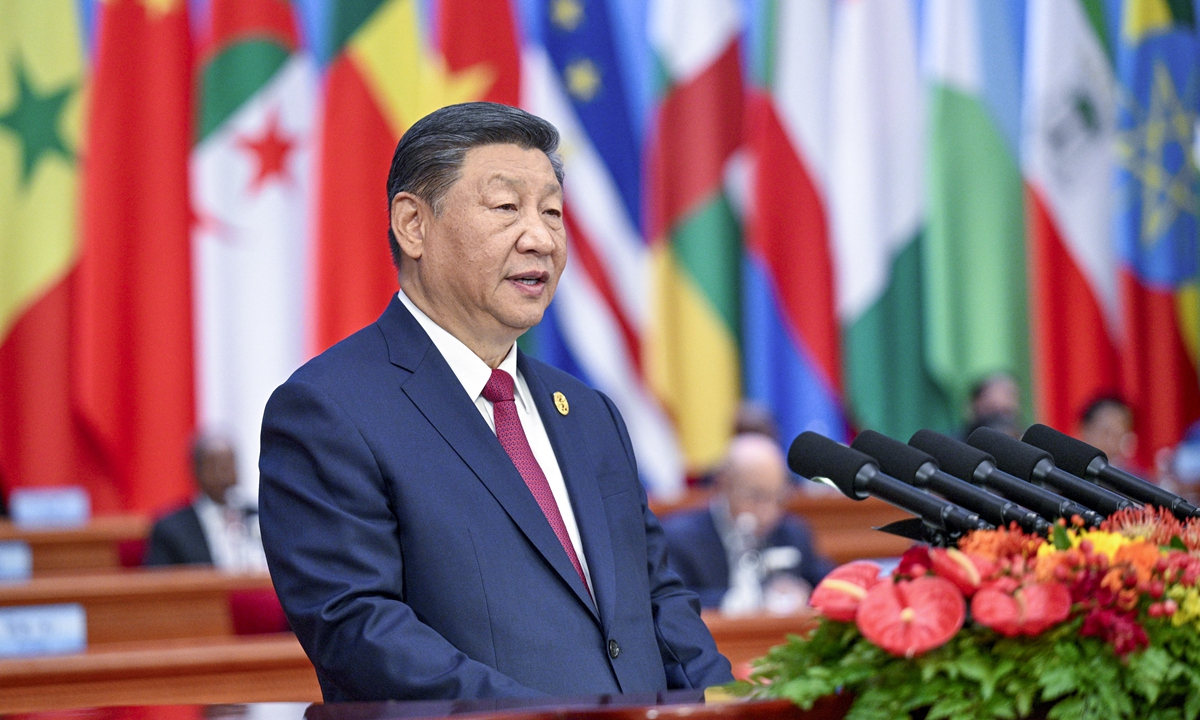

With the US-led financial consensus at a crossroads, economist Marc Uzan says China has role to play in systemic reform

French economist Marc Uzan is executive director and founder of the Reinventing Bretton Woods Committee, a non-profit organisation established in 1994 to address issues related to the world’s financial architecture. He has been working closely with central banks and finance ministries around the world, as well as international organisations such as the International Monetary Fund and the Group of 20, to bring stakeholders together to attempt to fix the system.

This question brought a multitude of thoughts about the objectives of the 44 nations whose representatives gathered at Bretton Woods, New Hampshire, in the summer of 1944 to establish a new economic order.

The world has changed considerably since then. Instead of a system of fixed exchange rates among major currencies, we now have a mixed system with major floating currency areas but fixed rates among smaller countries. At that time, we had capital controls, and now we are a global financial market. And from a small group of 44 countries that became the founding members of the International Monetary Fund (IMF) and Worl

U.S. debt just hit $35 trillion. Is it putting the global economy at

risk ...

Related posts: