European Central Bank president Christine Lagarde (pic) said the

economic recovery is “losing momentum more rapidly than expected” after

the partial rebound seen in the summer. She warned that the risks to

Europe’s economies are “clearly tilted to the downside”.

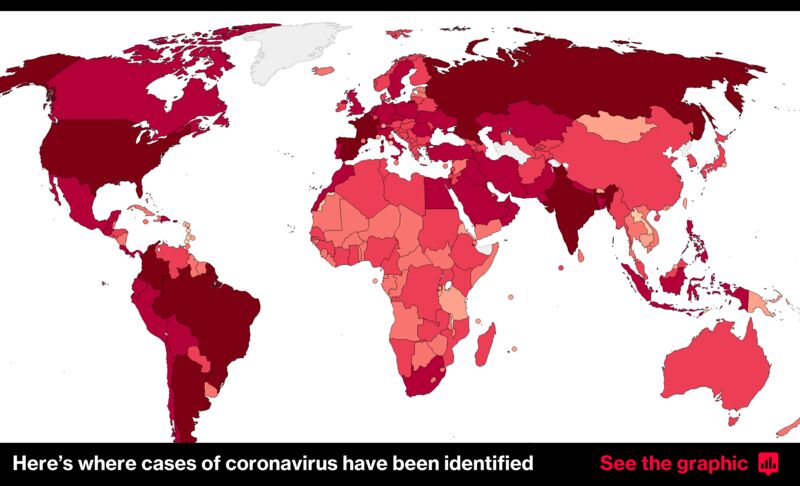

THE recent resurgence of the Covid-19 infections has cast a new shadow over the global economy, with lockdown measures taking place.

In France, President Emmanuel Macron has declared a nationwide lockdown starting today. It comes just days after German Chancellor Angela Merkel announced a four-week shutdown of bars, restaurants and theatres.

This week’s decline in global equities comes as investors grow increasingly worried about the economic recovery due to the sharp rise in the number of Covid-19 cases in Europe and in the US.

Over the past few weeks, there has been a series of new restrictions in many countries, including Malaysia, that make it harder to know where the economy is heading.

On Thursday, European Central Bank president Christine Lagarde said the economic recovery is “losing momentum more rapidly than expected” after the partial rebound seen in the summer.

She warned that the risks to Europe’s economies are “clearly tilted to the downside”.

The latest round of infections are causing a heightened level of uncertainties for governments to prepare fiscal and monetary responses.

International Monetary Fund (IMF) chief economist Gita Gopinath called on governments to continue fiscal support, including credit lines for small and medium businesses, wage subsidies and grants until the recovery is underway.

“To prevent large scale bankruptcies and ensure workers can return to productive jobs, vulnerable but viable firms should continue to receive support, wherever possible, through tax deferrals, moratoriums on debt service, and equity-like injections, ” she said in mid-October.

“Most economies will experience lasting damage to supply potential, reflecting scars from the deep recession this year, ” she added.

The IMF pointed out that Covid-19 remained the critical factor in economic recovery, and that “many more millions of jobs are at risk the longer this crisis continues.”

According to a recent estimate by the World Bank, up to 150 million more people may be pushed into extreme poverty by 2021.

The global economy is expected to decline by 4.4% this year before it expands to 5.2% in 2021, according to the IMF’s World Economic Outlook report published recently.

Interestingly, IMF data shows that emerging markets are likely to see a lower contraction of 3.3% this year compared to 5.8% decline in developed economies.

For the eurozone economy, the agency expects a slump in GDP by 8.3% in 2020, a level not seen since the 1930s Great Depression, with Spain likely to suffer the most.

The report predicts the Spanish economy to slide 12.8% followed by Italy, down by 10.6.%. Even the EU’s economic powerhouse, Germany, could contract by 6%.

Advanced economies’ recovery in 2021 would be slower than emerging economies, with GDP expected to grow 3.9% compared to 6%, the IMF believes.

The IMF said China, where the first cases of Covid-19 were reported, will be the only economy with positive growth for this year, with 1.9% expansion.

“While recovery in China has been faster than expected, the global economy’s long ascent back to pre-pandemic levels of activity remains prone to setbacks, ” it said.

China’s recovery from the pandemic is mostly coming from accelerating industrial production and robust export growth.

The US economy grew at a record pace in the third quarter. It expanded by an annualised 33.1% quarter-on-quarter following a plunge of 31.4% q-o-q in the preceding quarter as economic activities gradually resumed.

With the second wave of pandemic infections, though, some market observers suggest that a recovery remains uncertain.

MIDF Research said that on an annual basis, the US economy contracted 2.9% year-on-year in the third quarter, which is a “significant recovery” from the 9% fall registered in the second quarter this year.

“The recovery remains incomplete as the pandemic-induced crisis is far from over and the number of daily Covid-19 cases remains elevated.

“Tighter rules in other parts of the world such as in some European countries could be echoed by the US, which threatens the continuous recovery in the country, ” it said in a report yesterday.

In a report by Reuters, Moody’s Analytics chief economist Mark Zandi said rising Covid-19 cases, particularly in the winter months, could means a second economic hit from the virus, which is likely to be worse than the first time around.

He expects more business failures should the number of cases continue to spike.

“A lot of businesses were able to navigate together with the PPP money (Paycheck Protection Programme loans). Of course, consumers were able to hang in there, because they got all that consumer support from the government, ” he said.

“This time, if the pandemic intensifies and infections rise, it is going to be very difficult for these businesses to make it through, ” he added.

“We will see more business failures and the scarring effect, as economists say, will make it much more difficult for the economy to get back on track and get back to full employment.”

The IMF, meanwhile, has called on governments to rethink their spending priorities and direct funding to projects that will boost productivity, including green energy investments and education.

With debt on the rise in many countries, it said policymakers may need to increase taxes on the highest earners, cut out loopholes and deductions, and ensure that corporations pay their fair share of taxes while eliminating wasteful spending.

“This is the worst crisis since the Great Depression, and it will take significant innovation on the policy front, at both the national and international levels, to recover from this calamity, ” IMF said.

Source link

Related posts:

Summary of the 13th Five-Year Plan 2016-20

Infographic: GT During the 13th Five-Year Plan period, from 2016 to

2020, China has made great...