Share This

Thursday, 6 August 2020

Understanding the attraction between men and women

HOW many times have we all, at some point in our lives, misinterpreted signs?

Movies like He’s Just Not That into You, which is based on Greg Behrendt’s and Liz Tuccillo’s 2004 self-help book of the same name, tells people that if a man in whom you are interested in is not making an effort to pursue you, he is “just not that into you.”

Research has long indicated that it is mostly men, who tend to misperceive friendliness as sexual interest. They overestimate the sexual interest of potential mates. Even when two people have clearly defined their relationship as platonic, more often, it is the men, who are attracted to their opposite-sex friends.

According to Dr Goh Pei Hwa from the Jeffrey Cheah School of Medicine and Health Sciences, this is not always the case.

While the majority of existing findings show the abovementioned pattern of men overperceiving sexual interest, relationship researchers have demonstrated that among heterosexual couples in committed relationships, men were more likely to underperceive sexual interest from their partners.

Men from certain cultures were also less likely to overperceive sexual interest than others.

In other words, the “male over perception bias” appears to be less universal than previously assumed.

In her recent work, Dr Goh revisited the question of gender differences in sexual perception accuracy using a face-to-face, laboratory-based interaction paradigm on a sample of university students in Malaysia.

Participants consisted of 62 previously unacquainted heterosexual dyads aged 20 years on average. Each participant was randomly paired with another participant of the other sex, and each dyad engaged in a semi-structured conversation task for five minutes.

After the interaction task, participants completed measures capturing their degree of sexual interest in their interaction partner and an estimation of their partner’s sexual interest in them.

Results revealed that people’s perception of their partner’s sexual interest did not match their partner’s actual sexual interest. This indicates that people generally lacked accuracy in their perception of sexual interest.

In fact, people’s perception of sexual interest was highly in line with their own sexual interest in their interaction partner.

More importantly, no gender differences were found. This means that both men and women were equally inaccurate and equally likely to project their own sexual interest onto their estimations of their partner’s sexual interest.

“In essence, people are bad at interpreting sexual interest from strangers. Based on the research, Malaysian men do not overperceive sexual interest as past studies have suggested. Women, on the other hand, tend to underperceive sexual interest, supporting past studies,” says Goh.

The current study advances our understanding that people are generally underperceiving sexual interest in initial interactions, regardless of gender.

That is, people are either not communicating their sexual interest effectively or missing all the sexual interest cues being expressed by someone else.

Here, it translates into a lot of potentially missed opportunities. This is highly applicable to first meetings between potential partners, which begs the question: does technology further impede our ability to gauge the sexual interest of others accurately?

With dating apps, we typically already know that we are chatting with someone who finds us attractive or appealing to a certain extent.

Thus, there is no need to try to decipher whether or not someone is into us based on the interaction.

Goh concludes: “If you like someone or have some interest in a person, express it more overtly. This will invite the other person to respond according to his or her own interest in you.

“Let the other person decide if he or she is interested, not you and your potentially (or most likely) wrong perceptions”.

■ For more details, look out for the advertisement in this StarSpecial.

Source link

Wednesday, 5 August 2020

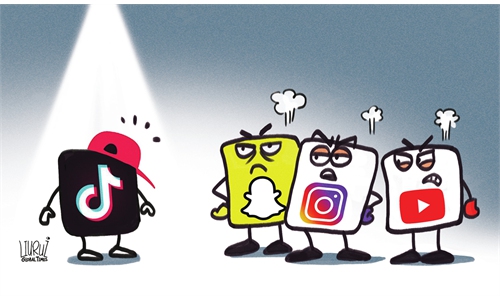

US president’s move to get a cut from TikTok as an ‘extortion threat’ and ‘mafia deal’

|

Washington robs TikTok by treading upon rules |

|

| TikTok for Business: What is TikTok Anyway? |

Countries mull reducing reliance on US tech in wake of TikTok drama

As the US shocked the free world with its mafia-style forced sale of Chinese-owned short-form video platform TikTok, Chinese

experts said that US extortion and looting have left a deep impression on the minds of the nations of the world, and pointed out that many of the countries are already striving to boost self-reliance in terms of

security, industrial independence and technological ownership.

Expert slams US president’s move to get a cut from TikTok as an ‘extortion threat’ and ‘mafia deal’.

https://youtu.be/cOgQnIJJRZs

https://youtu.be/j7Zi1CCtQIQ

https://youtu.be/j7Zi1CCtQIQ

| Controversial: Trump has said he would approve TikTok’s sale to Microsoft only if the US government gets a cut from the deal. — Reuters |

TikTok's roller-coaster ride in the United States continued on Monday as President Donald Trump said he would approve the video-sharing app's sale to Microsoft only if the US government gets a cut, a condition that one expert called a "mafia" deal.

The president also gave Microsoft and TikTok's Chinese owner, ByteDance, a deadline of Sept 15 to complete the deal, or the app will be banned in the US.

Foreign Ministry spokesman Wang Wenbin said at a regular media briefing in Beijing on Tuesday that the US treatment of TikTok is "outright bullying", and the US only uses a "national security risk" as an excuse to suppress Chinese tech enterprises.

"The relevant enterprises carry out business activities in the US following market principles and international rules and abiding by local laws and regulations," he said. "However, the US has set restrictions and suppressed them with unwarranted charges, which is political manipulation."

Wang said that if the wrongdoing by the US continues, then any country could take similar measures against any American enterprise on the grounds of national security.

"The US side must not open this Pandora's box, otherwise it will suffer its consequences," he said.

The increased scrutiny of TikTok culminated on Friday when Trump threatened to ban the app from operating in the US due to a "national security risk". The negotiations between the two companies were then halted.

But after a weekend phone call with Microsoft CEO Satya Nadella, Trump reversed his stance and reportedly gave the two companies 45 days to close the deal. This was confirmed by Microsoft on Sunday, which said in a statement it "will move quickly to pursue discussions" with ByteDance and complete the talks "no later than" Sept 15.

The president added a condition to the potential purchase on Monday: Microsoft should buy TikTok outright, and the US Treasury Department should be paid because the government made the deal possible.

"It's a little bit like the landlord/tenant; without a lease the tenant has nothing, so they pay what's called 'key money', or they pay something," Trump told reporters in the Cabinet Room at the White House on Monday. "But the United States should be reimbursed or should be paid a substantial amount of money, because, without the United States, they don't have anything."

Investors in privately owned Byte-Dance valued TikTok at $50 billion, according to a Reuters report.

Kai-Fu Lee, former chairman of Google China, said the US treatment of TikTok, including "forced acquisition, plus only 45 days, plus finder's fees", is "incredible".

Lee said that China has set clear rules for internet companies that want to operate in the country, and Google had decided to exit as it didn't want to comply with Chinese laws and regulations.

"The US didn't give any parameters that TikTok could work with, and didn't provide any evidence for their claims that TikTok had caused national security risks to the US," he said.

The legal basis of Trump's requirement that some of the money from the deal go to the US Treasury was immediately questioned by experts.

"This is quite unusual; this is out of the norm," Gene Kimmelman, a former chief counsel for the US Department of Justice's Antitrust Division, told CNN.

"It's actually quite hard to understand what the president is actually talking about here.... It's not unheard of for transactions to have broader geopolitical implications between countries, but it's quite remarkable to think about some kind of money being on the table in connection with a transaction," said Kimmelman, a senior adviser to the policy group Public Knowledge.

Julian Sanchez, a senior fellow at the Cato Institute, a think tank based in Washington, D.C., said Trump's "extortion threat" is a "mafia business model".

"Trump's full explanation of why the Treasury should get a 'cut' of a Microsoft/TikTok deal is, somehow, even more grotesque and shameless than I had anticipated," said Sanchez.

"As with his tariff policy, there doesn't seem to be any consideration of whether this sets a dangerous precedent for other countries to engage in similar pretextual protectionism against us, or how whimsically compelling divestment might affect international investment," he said.

Samm Sacks, a senior fellow at Yale Law School's Paul Tsai China Center, also warned that shutting down the app altogether would set "a dangerous precedent in which the US government can blacklist companies based on country of origin using blanket national security as justification".

The Trump administration has been scrutinizing TikTok for several months, claiming that the platform shares the data of US users with the Chinese government. The company has repeatedly denied the accusations, maintaining that all the users' information is stored in the US.

Source link

Related:

While China is busy innovating, the US is guarding

against an innovative China. This twisted behavior has prevented the US

from continuing to innovate and reform. The dominant position it

acquired, or its hegemony, is becoming a self-inflicted fetter for its

progress.

The president also gave Microsoft and TikTok's Chinese owner, ByteDance, a deadline of Sept 15 to complete the deal, or the app will be banned in the US.

Foreign Ministry spokesman Wang Wenbin said at a regular media briefing in Beijing on Tuesday that the US treatment of TikTok is "outright bullying", and the US only uses a "national security risk" as an excuse to suppress Chinese tech enterprises.

"The relevant enterprises carry out business activities in the US following market principles and international rules and abiding by local laws and regulations," he said. "However, the US has set restrictions and suppressed them with unwarranted charges, which is political manipulation."

Wang said that if the wrongdoing by the US continues, then any country could take similar measures against any American enterprise on the grounds of national security.

"The US side must not open this Pandora's box, otherwise it will suffer its consequences," he said.

The increased scrutiny of TikTok culminated on Friday when Trump threatened to ban the app from operating in the US due to a "national security risk". The negotiations between the two companies were then halted.

But after a weekend phone call with Microsoft CEO Satya Nadella, Trump reversed his stance and reportedly gave the two companies 45 days to close the deal. This was confirmed by Microsoft on Sunday, which said in a statement it "will move quickly to pursue discussions" with ByteDance and complete the talks "no later than" Sept 15.

The president added a condition to the potential purchase on Monday: Microsoft should buy TikTok outright, and the US Treasury Department should be paid because the government made the deal possible.

"It's a little bit like the landlord/tenant; without a lease the tenant has nothing, so they pay what's called 'key money', or they pay something," Trump told reporters in the Cabinet Room at the White House on Monday. "But the United States should be reimbursed or should be paid a substantial amount of money, because, without the United States, they don't have anything."

Investors in privately owned Byte-Dance valued TikTok at $50 billion, according to a Reuters report.

Kai-Fu Lee, former chairman of Google China, said the US treatment of TikTok, including "forced acquisition, plus only 45 days, plus finder's fees", is "incredible".

Lee said that China has set clear rules for internet companies that want to operate in the country, and Google had decided to exit as it didn't want to comply with Chinese laws and regulations.

"The US didn't give any parameters that TikTok could work with, and didn't provide any evidence for their claims that TikTok had caused national security risks to the US," he said.

The legal basis of Trump's requirement that some of the money from the deal go to the US Treasury was immediately questioned by experts.

"This is quite unusual; this is out of the norm," Gene Kimmelman, a former chief counsel for the US Department of Justice's Antitrust Division, told CNN.

"It's actually quite hard to understand what the president is actually talking about here.... It's not unheard of for transactions to have broader geopolitical implications between countries, but it's quite remarkable to think about some kind of money being on the table in connection with a transaction," said Kimmelman, a senior adviser to the policy group Public Knowledge.

Julian Sanchez, a senior fellow at the Cato Institute, a think tank based in Washington, D.C., said Trump's "extortion threat" is a "mafia business model".

"Trump's full explanation of why the Treasury should get a 'cut' of a Microsoft/TikTok deal is, somehow, even more grotesque and shameless than I had anticipated," said Sanchez.

"As with his tariff policy, there doesn't seem to be any consideration of whether this sets a dangerous precedent for other countries to engage in similar pretextual protectionism against us, or how whimsically compelling divestment might affect international investment," he said.

Samm Sacks, a senior fellow at Yale Law School's Paul Tsai China Center, also warned that shutting down the app altogether would set "a dangerous precedent in which the US government can blacklist companies based on country of origin using blanket national security as justification".

The Trump administration has been scrutinizing TikTok for several months, claiming that the platform shares the data of US users with the Chinese government. The company has repeatedly denied the accusations, maintaining that all the users' information is stored in the US.

Source link

Related:

US degrades from innovator to digital rogue

US degrades from innovator to digital rogue

While China is busy innovating, the US is guarding

against an innovative China. This twisted behavior has prevented the US

from continuing to innovate and reform. The dominant position it

acquired, or its hegemony, is becoming a self-inflicted fetter for its

progress.

Hard to say who will surprise you in the future, US or TikTok

In addition to power, there exist rules and morals in this world. Although Trump's power can overwhelm rules and ethics, he has only fewer than three months left before the presidential election. People have a subtle perception of rules and ethics in their minds. Trump could thus lose votes due to any most slightly careless move.

TikTok ban demonstrates barbaric act of rogue US: Global Times editorial

In the most barbaric way, the US is trying to solidify a high-tech world order in which it is the absolute center. Whether it ends up "killing" TikTok or forcibly taking the child out of Bytedance's arms, it is one of the ugliest scenes of the 21st century in the high-tech competitionTrump wants to kill TikTok

We are not the enemy: TikTok chief

https://youtu.be/4bS5ukQGa_Y

TikTok users take on Trump

https://youtu.be/Jo6LHELhhnM

Related posts:

US adopts blinkered view of TikTok

Unknown Chinese startup creates the world's most valuable Bytedance

Tuesday, 4 August 2020

No smartphone = problems living in Penang

Please resolve the parking and soon-to-be marketing woes of constituents who do not own and do not wish to own smartphones.

LIVE in Penang, and while I usually try to catch the infrequent Rapid bus, walk or bike, I do drive when I need to. However, I have an intractable problem with parking at Penang City Council-designated parking lots because I do not own a smartphone.

The state government implemented an e-parking system at the start of this year. My old phone does not allow me to download the e-parking app.

To compound my parking woes, I am unable to purchase parking coupons – they are no longer available as a result of the new system.

I have actually paid the council RM40 for unused, 2019 parking coupons.

Effectively, I have already paid for public parking which I cannot make use of. I went to the council recently, hoping to exchange the outdated parking coupons for current ones or to try and get my money back.

I explained my problem, fanned out the “virgin” parking coupon booklets and showed my phone.

The staff that I talked to said he couldn’t help.

When I insisted that I am not getting a service I had already paid for, he said I should document my complaint in a complaints form.

“You are not the first person to complain. Many have already complained before you.”

“So what happened to their complaints?” I asked.

“Nothing, no action was taken, ” was his reply.

“You want me to waste my time filling out a complaint form when many have already done the same and no action was taken?”

I realised then that the city council was only implementing a policy that the Penang government had pushed through without thinking of the needs of all in the community.

Did the state government not receive the complaints that had been lodged by those who do not have smartphones and are facing parking woes? How is this segment of the population to park at council parking lots?

Buy a smartphone? That is not right, some of us make a conscious choice not to own a smartphone because, hey, smartphones are so not smart for the planet.

Another problem looms on the horizon for this segment of our community: the state government plans to implement the use of an e-wallet app at local markets. I will not be able to buy fresh, local produce there because I don’t have a smartphone.

The state government’s “Green, Clean Penang” does not take into account the environmental impact of smartphones and their usage for basic services like marketing and parking.

Apart from the carbon footprint of manufacturing smartphones that only last for two to three years, the way smartphones are used has a huge environmental impact too. Among the largest generators of CO2 emissions are the servers and data centres that calculate every Google search, every Facebook post, and even every time we open an app.

To those calling the shots at the Penang government, please resolve the parking and soon-to-be marketing woes of your constituents who do not own and do not wish to own smartphones.

TEH AWA MUTU Penang

Source link

Read more:

Related post:

‘It’s the right time to invest’

We found that data availability and transparency in the real estate

sector is less than what we were used to when we were working in the

financial industry and we are set to change that, ” says Red Angpow

co-founder Erhan Azrai.

PETALING JAYA: Even as many consumers are cautious in purchasing high-ticket items in light of the Covid-19 pandemic, industry experts say sale of properties and cars have been rising since June.

Real Estate and Housing Developers Association (Rehda) Malaysia national council member Tony Khoo Boon Chuan said property sales had picked up since June, thanks to lower interest rates and the extension of the government’s Home Ownership Campaign (HOC) until 2021.“No doubt buyers are guarded when buying high-priced products.

“But others who are not affected financially also realise the time is here to buy or invest in a new property, ” he said in an interview.

Apart from the HOC’s 10% discount on the selling price, Khoo said buyers also enjoy incentives such as stamp duty exemption, free legal fees and freebies such as home security and alarm systems, additional cabling, fittings and fixtures.

“There are so many choices with perks and benefits in the market now for buyers.

“This is indeed the right time to invest, ” he said.

HOC is a government initiative in 2019 aimed at supporting homebuyers, and it has been reintroduced in June under the Penjana economic revival plan.

Khoo noted that the government’s exemption of real property gains tax for Malaysians for disposal of up to three properties had made it easy for property sales in the secondary market.

“This will certainly encourage a lot of investors and buyers who are looking to upgrade, ” he said.

In the automotive industry, both new and used cars have seen brisk sales in recent months, with foot traffic at showrooms having increased tremendously.

Malaysian Automotive Association (MAA) president Datuk Aishah Ahmad said new car sales improved to 42,000 in June, compared with 22,000 in May, following the government’s announcement to remove the sales tax for certain categories of vehicles.

“Many car companies are offering lots of discounts and attractive hire purchase rates to entice customers, ” she said.

Although many car buyers are still cautious, she said premium cars purchases did not see much problem.

In fact, Aishah said MAA had readjusted the forecast of Malaysia’s total industry volume to 470,000 for this year, versus the earlier forecast of 400,000.

Federation of Motor and Credit Companies Association of Malaysia president Datuk Tony Khor Chong Boon agreed, adding that the used car market had also experienced tremendous growth in July.

“June sales were on par with full recovery following the recovery movement control order.

“July was very encouraging with 37,880 units sold, which is 25% higher than the same month last year, ” he said, adding that it was the highest monthly sales achieved in the last five years.

In contrast, he said used car sales only chalked up 303 units in April, when the usual monthly figure was between 30,000 and 35,000 units.

Khor said several factors contributed to the recent good vibes in the automotive industry, with measures introduced in the government’s economic revival plan shown to work.

“The moratorium has allowed some to have more money to spend, while the sales tax exemption has stimulated sales.

“Some buyers choose to get a car due to concerns about physical distancing and hygiene in public transport, ” he said, adding that used cars costing around RM30,000 were popular.

He noted that brisk sales of used cars resulted in a long waiting time for inspection at Puspakom, with a minimum wait time of at least five to seven days, and even 10 days or more at some locations.

When asked, Khor said it was hard to predict how long the good vibes would last because the real challenge would come when many borrowers are required to pay when the moratorium is lifted beginning October.

“To keep the market and economy stimulated, the government has to periodically come out with relevant measures and policies, ” he said.

Human resource executive CW Lim, who has been househunting for a few months, said he would make use of the discount and offers to buy a house in the Klang Valley.

“With the HOC, I’ll be able to save tens of thousand in downpayment, stamp duty fees and legal fees that could take me years to save up.

“Since my job and industry is not affected much, I hope I will soon own a house through these offers, ” said the 30-year-old from Klang.

Clinic nurse Farisha Azman, 29, who has been commuting to work from Subang Jaya to Shah Alam daily using the train, said she was in the process of buying a new car.

“Not having to worry about distancing on the train gives me peace of mind, ” she said.

Serving property investors’ needs

WITH the property market expected to remain soft over the next few months, tech startupRED ANGPOW Analytics is hopeful that property owners will be knocking on its doors for help to better manage their asset portfolios.

The company does online map-based real estate due diligence, feasibility study and price analytics.

“We foresee asset holders requiring good information to manage their portfolios. Data on past transactions that have been useful will no longer be enough.

“We found that data availability and transparency in the real estate sector is less than what we were used to when we were working in the financial industry and we are set to change that, ” says Red Angpow co-founder Erhan Azrai.

The startup generally has two groups of target clients, which are development-based organisations and individuals who use research to make decisions such as property investors, analysts, researchers, valuers and banks. Red Angpow’s services are not only useful for developers, but also related industries that are supporting real estate.

Erhan notes that clients are becoming savvier and are looking for more opportunities in the soft property market and they will need more relevant data to make their investment decisions.

“After the 1997-1998 financial crisis, the National Property Information Centre (NAPIC) was created to provide accurate and timely information on the property market.

“In the current environment, we believe the timing is right for an enhanced service.

“In the longer term, there is a need to increase the efficiency of the real estate market with a lot more data transparency.

“From the work that we have done so far, we saw that a lot of data is actually available, but it is unstructured and comes from multiple sources.

“Before we can compile all this data via an artificial intelligence means, we are doing the very basic first, which is getting the data cleaned, tagged and harmonised in a form that can be used easily by researchers, ” he says.

He adds that ensuring property investors have timely and accurate data has become even more important now as real estate loans make up a sizeable portion of total loans.

As of February 2020, Erhan notes that real estate loans in the banking system stood at RM836bil or 47% of total loans.

“This staggering amount needs better data to manage the portfolio, especially when industries are cutting jobs. A 10% downward correction will affect up to 5% of the total loan portfolio, depending on the age of the loan asset. That’s a huge amount.”

While the movement control order (MCO) has hindered some of its plans, Red Angpow has been fortunate to have raised enough capital to weather the course for the next two years.

“So, we are going to stay the course. The MCO allows us to hunker down and complete our work. We planned to launch a subscription for property analytics dashboard by July. But we are confident that we will hit the ground running once again after the MCO is lifted, ” he says.

Related posts:

( From left) Chow looking at the Penang NCER human capital graphic info. With him are John, state executive councillor Datuk Abdul Halim .

https://youtu.be/wT4fZ9IcR6c

https://youtu.be/nzqy79-m8Z0 Extension for those in need | The

Star Rapt attention: Laun...

Do we still need an office?

Saturday, 1 August 2020

Global de-dollarisation fast underway; US Printed More Money in One Month Than in Two Centuries, US$ is fast becoming Banana Currency

Changing trend: Looking from the perspective of the US debt, the 22 consecutive months from April 2018 to March 2020 saw global central

banks reduce their US debt holdings.

A global trend toward “de-dollarisation” has already begun. The last piece of “load-bearing wall” of the “US Empire State Building” has cracked, in other words.

Global policies for “de-dollarisation” include sharply reducing US debt holdings, dropping US dollar’s status as an anchor currency, increasing non-dollar bulk commodity trade, growing the reserve of non-dollar currencies and ramping up gold’s hedge against the dollar.

Looking from the perspective of the US debt, the 22 consecutive months from April 2018 to March 2020 saw global central banks reduce their US debt holdings.

In March, the US Federal Reserve pledged unlimited quantitative easing, purchasing over US$1 trillion Treasuries within a month.

The Federal Reserve has become the largest receiver of US Treasuries.

In the same month, yields on both one-month and three-month Treasury bills were negative, while the yield for the 10-year Treasury hit below 1% for the first time, according to media reports.

This exemplifies global anticipation of a weaker US economy.

Although the possibility that a small number of foreign investors will increase their holdings of US Treasuries in the short run cannot be ruled out, in the long run international investors will likely reduce their US debt holdings.

The Federal Reserve, which has spent over half a century building up its global credibility, has become the last ditch of US Treasuries.

In recent years, many G20 members such as China, France, Germany, and Russia have reduced their use of the US dollars in trade deals.

According to information disclosed by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), the share of US dollars in the international payment market in May was 40.88%, a drop from 44.1% in March.

While the market estimates there is still a long way to realise “de-dollarisation”, some countries are becoming restless to achieve it.

The SWIFT system, which has been traditionally used for trade clearance and payments, and which is overwhelmingly controlled by the United States, has been widely criticised across the world.

Many countries are striving to construct de-dollarising payment systems. For example, China launched the Cross-border Interbank Payment System in 2015.

It is very likely that the share of US dollars in international payment systems will drop to below 40%.

The share of the US dollar in total foreign exchange reserves of all IMF member countries has fallen from 72% in 2000 to 61.99% at the end of the first quarter in 2020.Although the US dollar’s share of foreign exchange reserves still ranks first worldwide, its decline in recent years is quite obvious.

Countries are determined to diversify their foreign exchange reserves.

It can be seen that central banks of many countries have increased their gold reserves, and the year 2019 marked the 10th consecutive year of annual net purchases of gold.

To offset risks brought by US dollars, the US share in global gold reserves fell from 23.64% at the end of June 2019 to 15.5% at the end of June 2020.

This reflects the weakening of trust in the US dollar by many countries.

It is conceivable that the US sanctioning against China due to the country’s national security legislation for Hong Kong will further accelerate most countries’ “de-dollarisation” programmes.

In addition to US Treasuries, payments as well as foreign reserves, digital currency and the Covid-19 pandemic are the latest factors that trigger the hastening of the “de-dollarisation” progress.

Digital currency seeks a comprehensive replacement of the US dollar as the primary international currency in terms of issuance, technology and tools.

Major economies including China, the EU, and Japan, plus many multinational corporations, have conducted long-term digital currency research.

Since the beginning of the 21st century, many doubters of “de-dollarisation” have been holding that global “de-dollarisation” is still in its infancy.

They feel markets are very dependent on the US dollar. But the Covid-19 pandemic seems to have triggered a faster “de-dollarisation” progress.

In view if the various diplomatic considerations and the market’s expectations for the US dollar, one can conclude that the United States can never form a strategic containment circle against China.

China is confident of this.

By Wang Wen,The author is professor and executive dean of Chongyang Institute for Financial Studies at Renmin University of China, and executive director of China-US People-to-People Exchange Research Centre. His latest book is Great Power’s Long March Road.wangwen2013@ruc.edu.cn. Chongyang Institute for Financial Studies is a private think tank set up by Qiu Guogen, an alumni of Renmin University and chairman of Shanghai Chongyang Investment Group Co Ltd.

US Printed More Money in One Month Than in Two Centuries

The Federal Reserve’s money printer has cranked up to ridiculous levels — but will it really lead to inflation?

In a letter to investors released on July 29, Pantera Capital CEO Dan Morehead noted that the United States has printed a shocking amount of money to combat the pandemic-induced financial crisis.

“The United States printed more money in June than in the first two centuries after its founding,” Morehead wrote. “Last month the U.S. budget deficit — $864 billion — was larger than the total debt incurred from 1776 through the end of 1979.”

Morehead made it clear that Pantera Capital sees Bitcoin as the solution for the current crisis. He also contrasted the effects of money printing in recent months, to how the equivalent amount of currency had performed across centuries:

“With that first trillion [USD printed] we defeated British imperialists, bought Alaska and the Louisiana Purchase, defeated fascism, ended the Great Depression, built the Interstate Highway System, and went to the Moon.”

Morehead cited the resulting inflation as the main reason one should “get out of paper money and into Bitcoin.” According to the CEO, “there is no need for inflation-adjusted numbers [with Bitcoin] because there is no inflation/hyper-inflation.”

Going to zero

Goldbug Peter Schiff is also concerned about the effects of money printing. He noted comments by the Chair of the Federal Reserve, Jerome Powell, who said this week that the Fed was using its “full range of tools” to respond to the pandemic: printing money, keeping interest rates close to zero, and making asset purchases steady at $120 billion per month.

“The U.S. is about to experience one of the greatest inflationary periods in world history,” Schiff said on Twitter. “Any credibility the Fed has left will be lost. Federal Reserve Notes soon won't be worth a Continental.” (Continental paper money in the U.S. was at one time exchanged for treasury bonds at 1% of its face value.)

Inflated prices as well?

Despite widespread fears over inflation, many experts predict consumer prices will actually go into a period of deflation — and that’s exactly what’s happened in Australia this week where ABC News reported that consumer prices in the country actually dropped 1.9% in June. It’s a record for deflation since the Korean War.

However many pundits believe the inflation is actually hidden in asset prices, rather than consumer prices, and that money printing has underpinned the share market rally in the midst of the pandemic.

Pantera Capital revealed its simple investment strategy for riding out the pandemic:

“Stay long crypto until schools/daycare open. Until then the economy won’t function and money will be continuously printed.”

Related:

Bloomberg: Americans Trade Depreciating Dollars For Bitcoin

Bitcoin Price Hits 2020 High at $11.5K as Traders Say 'Bull ...

Trump Is ‘Blaming Black And Brown People For Covid-19 Surge https://youtu.be/HNxfYf_1ud8 Joe speaks with Jason Johnson,

Morgan St...

Subscribe to:

Comments (Atom)